The trends shaping 🇨🇦 climate tech in 2024 & a look back at 2023

We dive into the top trends for climate tech VC in Canada, plus a look at what the future holds across carbon capture, EV supply chains, and clean energy

Hey there,

It’s safe to say that 2023 was one of the hardest years for startups in a long time. Climate tech wasn’t unaffected, but fared better than most. Today we’ll take a look back at what happened in Canadian climate tech funding and the trends that will shape the year ahead.

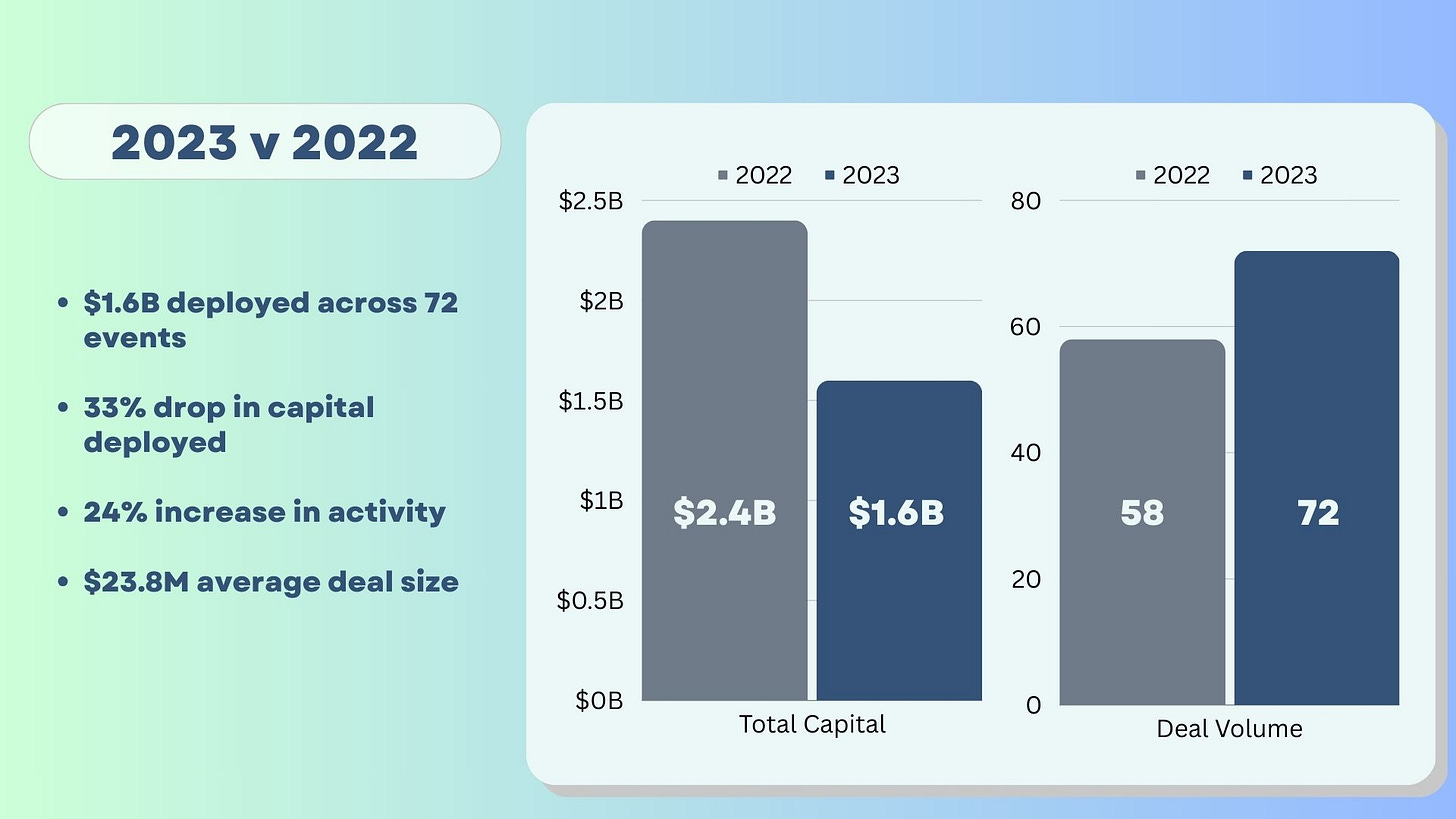

A bird’s eye view of 2023 climate venture funding

2023 saw a drop in capital being deployed, but more deals being done. This was a pretty consistent trend across tech in 2023 as markets cooled down from high capital costs. Globally, climate investment also saw a drop in capital (-30% v 2022) and a 3% drop in activity.

Canada hasn’t experienced the same slowdown in deals as the wider market, particularly at early stages. The average deal size also dropped substantially (from $44.5M to $23.8M) but the median size stayed virtually flat, due to fewer mega-raises.

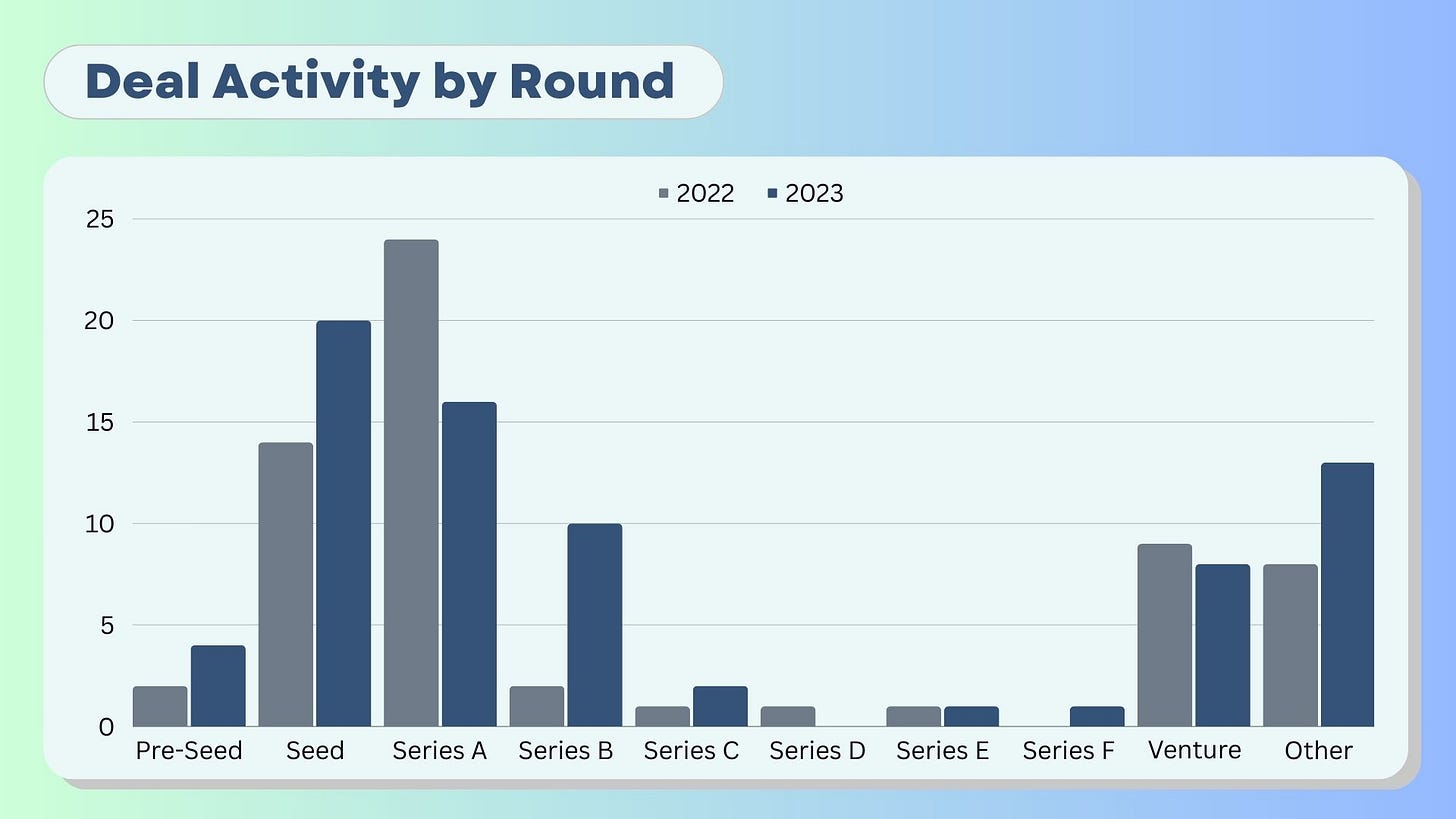

Active early stages

Deal activity skewed earlier this year, with early stage (pre-seed to A) making up 55% of deals. Series B was more active as well.

The largest pullback in capital was late-stage and corporate strategic investment rounds. 2023 saw just $124M in Series C+ compared to $858M in 2022. Corporates invested $23M in 2023 led by Nano One’s $16.9M investment from Sumitomo Metal Mining. Compare that to more than $500M in 2022 with deals from Glencore ($260M for Li-Cycle) and energy company Repsol ($255M for Enerkem).

Strong year for Energy & Industry

Energy stayed strong with 30% of all funding. Eavor led the pack with $192M followed by nuclear with General Fusion and Aalo Atomics.

Carbon was mostly made up by Entropy’s $200M investment from the Canada Growth Fund, but also included Deep Sky’s Series A.

In Climate Management, emissions reporting was particularly active with several seed rounds and Series Bs from Qube and SensorUp. Five of the seven companies that raised funding focus on the oil & gas sector. (Note: while it looks like the sector cratered, the difference is due to Assent Compliance’s $350M Series D in 2022).

Industrial saw significant investment in mining & refining and chemicals & plastics. GeologicAI, pH7 Technologies, Cyclic Materials, and erthos all raised Series As.

Transportation dried up compared to 2022 which had a few +$100M rounds for batteries and twice as many deals.

A quick note on regions: The distribution of capital remains the same year-over-year. Ontario has the most activity followed by Quebec, Alberta and B.C. Alberta raises the most capital, largely driven by the energy sector. Nova Scotia continues to grab the #5 spot, with 4 rounds this year including CarbonCure’s $105M raise and Graphite Innovation Technologies’ $10M Series A.

The year ahead

Don’t call it a prediction, but here are a few things that I think will shape Canadian climate tech this year.

🪂 A soft landing for the economy?

It looks like interest rates could start cooling this year as Canada and the U.S. try to engineer a soft landing for the economy. It’s not clear what’ll happen to investment levels - a couple of ways this could go:

Capital becomes less expensive, unlocking pilot and demonstration plants for hardware startups. Startups that focused on fundamentals come out stronger.

Investors stay cautious until there’s more economic certainty. More startups get acquired as cash reserves run out and patient corporates step in. Climate IP could be more attractive, particularly for energy companies.

In reality, we’ll likely see a mix of both of these scenarios. Be ready for some media / politicians to point to climate startup failures as proof of their own biases against climate action, specific energy sources, government funding programs, etc.

🏦 Clean tax credits level the playing field

Canada’s investment tax credits for climate tech should be coming out this year. With tax credits for carbon capture utilization & storage, clean tech, hydrogen, and clean tech manufacturing, Canada will level the investment playing field with the U.S. Coupled with lowering interest rates, this could be a big moment for climate tech’s capital intensive projects.

We’ll also see more action on the government front as the Canada Growth Fund continues to roll out, a hopeful reactivation of Sustainable Development Technology Canada, and policy tailwinds from clean energy and zero-emission vehicle regulations.

🔋 An emerging EV & battery supply-chain

It seemed like you couldn’t go a day without hearing about EV and battery supply chains last year. Canada had some major investments last year - new plants from GM, Volkswagen, E-One, Northvolt and Stellantis. Ontario in particularly seems laser focused on building out the supply chain. But there’s more to unlock:

Can we figure out the move from foreign-owned branch plants to building homegrown successes? Across the supply chain, more Canadian winners means more capital feeding back into the ecosystem.

We also need to figure out access to minerals, whether at home in places like the Ring of Fire or Canadian mining operations around the world. Canada has a wealth of mining knowhow - can we unlock this potential to be a leader in responsible mining for the energy transition?

⚡️ Clean energy underdogs

Two underdogs of clean energy - geothermal and nuclear energy - had big years. Eavor closed $182M following successful demonstrations of its closed-loop geothermal system. Geothermal hasn’t gotten much love due to challenges with drilling and costs. But it’s starting to get recognized for it’s potential to provide base-load power that complements wind and solar - like Google’s new geothermal-powered data centres.

Nuclear also had a milestone year. ARC Clean Energy and Moltex were tapped to build out SMRs in New Brunswick and Aalo Atomics raised a seed round to tackle economic nuclear fission. But the social / political changes might have bigger impacts - countries at COP signed up to triple nuclear generation, federal and provincial governments are backing nuclear, and Bruce Power pulled off a major refurbishment in an industry known for being over budget and behind schedule. This could be the beginning of a narrative shift around nuclear as we get some distance from nuclear accidents and appreciate the benefits / necessity for the grid.

Nailing clean energy is also becoming more important as the limiting factor for more investment in other key sectors. All the industries we need to build for the energy transition - mining, refining, metals, carbon capture - rely on abundant clean energy. Quebec will max out its surpluses by 2026 and Alberta is issuing emergency warnings for its grid. We need to deploy clean energy faster and expand grids to not fall behind.

👷 Building a carbon ecosystem

Canada has a huge opportunity to lead across the carbon ecosystem, whether CO2 removal (CDR), carbon reporting or emissions monitoring. The upside of an extensive fossil fuel industry means workers with the skills for carbon removal & storage and abundant coastlines, geologic storage, and agriculture lands that could support projects across a range of CDR methods. We also have an ecosystem - banks, energy companies, engineering firms - that knows carbon well and is increasingly being required to quantify and disclose their emissions, spurring a carbon management market. A few standouts:

Carbon remover Carbon Engineering’s $1.1B exit to Occidental Petroleum, and Deep Sky launched, aiming to be the first gigaton scale carbon removal developer

Space-based emissions tracking startups like GHGSat are already helping track down emitters.

Side note: I’m loving the energy that Deep Sky is bringing to the table. They just came out swinging, locking in tech partners, bringing together the ecosystem, and doing it in an ambitious way that we don’t often see.

🤝 The year of the climate career

Thousands of people are on the market after layoffs in 2023, and more will enter as startups shut down or continue to find efficiencies. It's seems like every week, I talk to someone who wants to work on climate. I'm hopeful that 2024 is the year of the climate career in Canada as more people use this as an opportunity to work on meaningful problems. Hey, if you're going to do B2B SaaS it might as well help drive down emissions, right?

Communities are starting to form around this too - climate tech meetups are popping up in Montreal, Toronto, Calgary, Ottawa and others. More people are picking up on the opportunity in climate and getting together to learn and build.

A final note

2023 was one of the hardest years in tech for many people. High interest rates and cautious capital made it harder to deploy climate solutions, and thousands of people hit the job market as companies cut costs.

We’re not out of the woods yet, but strong tailwinds are starting to blow from cooling interest rates, solidifying climate regulations, and more competitive subsidies. I’m looking forward to diving into these trends more with you this year in deep dives, in-person events and talking to founders on the podcast!

Thanks for reading,

Justin

Have a different take on climate trends? Or interested in diving deeper into the numbers? Give me a shout at hello@climatetechcanada.ca.

Appendix

A quick note on data: The data is based on public fundraising announcements. I categorized transactions to the best of my ability (and inadvertently learned more than I wanted to about private equity), but it’s not perfect. It’s also a small data set, so the inclusion / exclusion of one data point can skew things a lot. I’ve called this out where possible.

Verticals: Broadly, I consider climate tech to be companies creating technology that is intentionally reducing emissions, adapting to climate change, or helping monitor and quantify climate impact. I used Climate Tech VC’s classifications for Vertical and Industry.

Further Reading:

Chris Neumann of Panache Ventures has a great post on the Canadian tech market at large that dives into some of the dynamics at play.

CTVC also published an excellent report on global climate venture funding that’s worth checking out.