Shifting tides: A mid-year pulse on climate tech funding

The state of VC funding for Canadian climate tech in H1/2024

Hey there,

Every six months, I share a recap on what’s been happening in venture capital funding for climate tech. The intent is to zoom out from the day-to-day and get a sense of the state of investment in climate tech, where capital is flowing, and where there are gaps.

A quick preview of what’s in this deep dive:

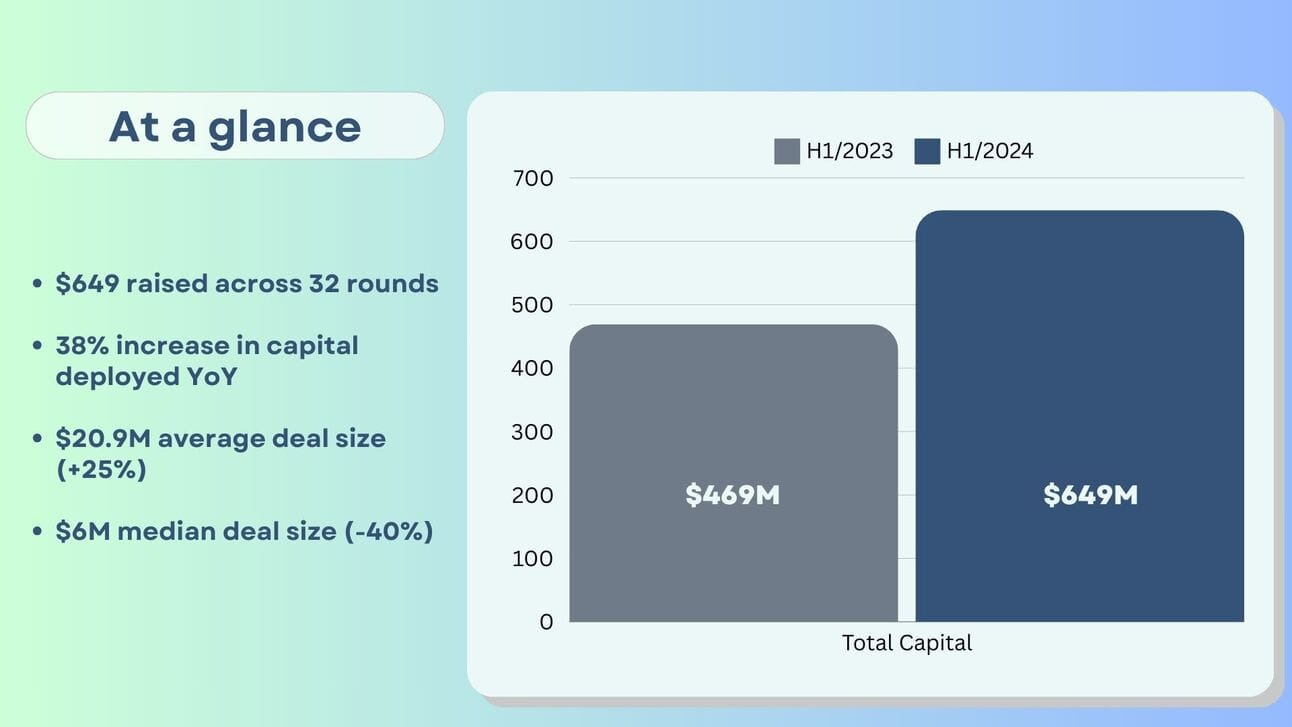

We tracked $650 million raised across 32 deals, up 38% vs H1 last year.

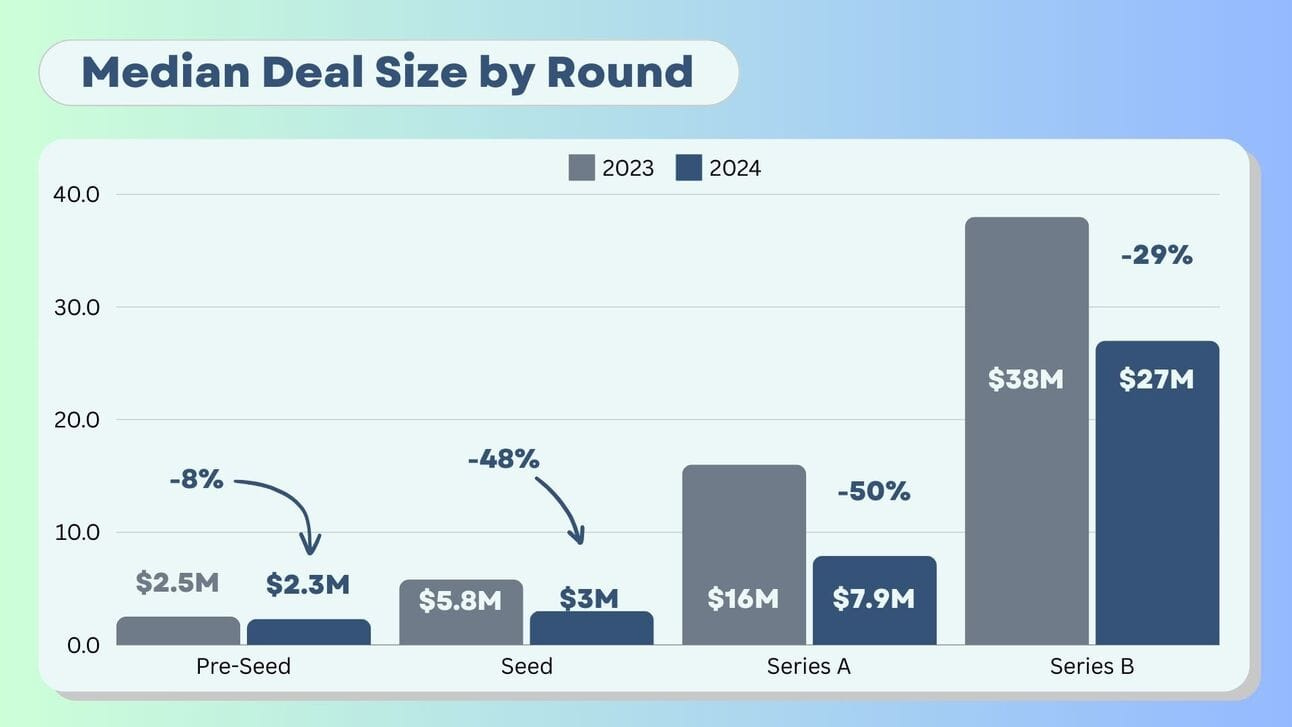

The median early stage round was ~50% smaller and capital skewed towards later stages.

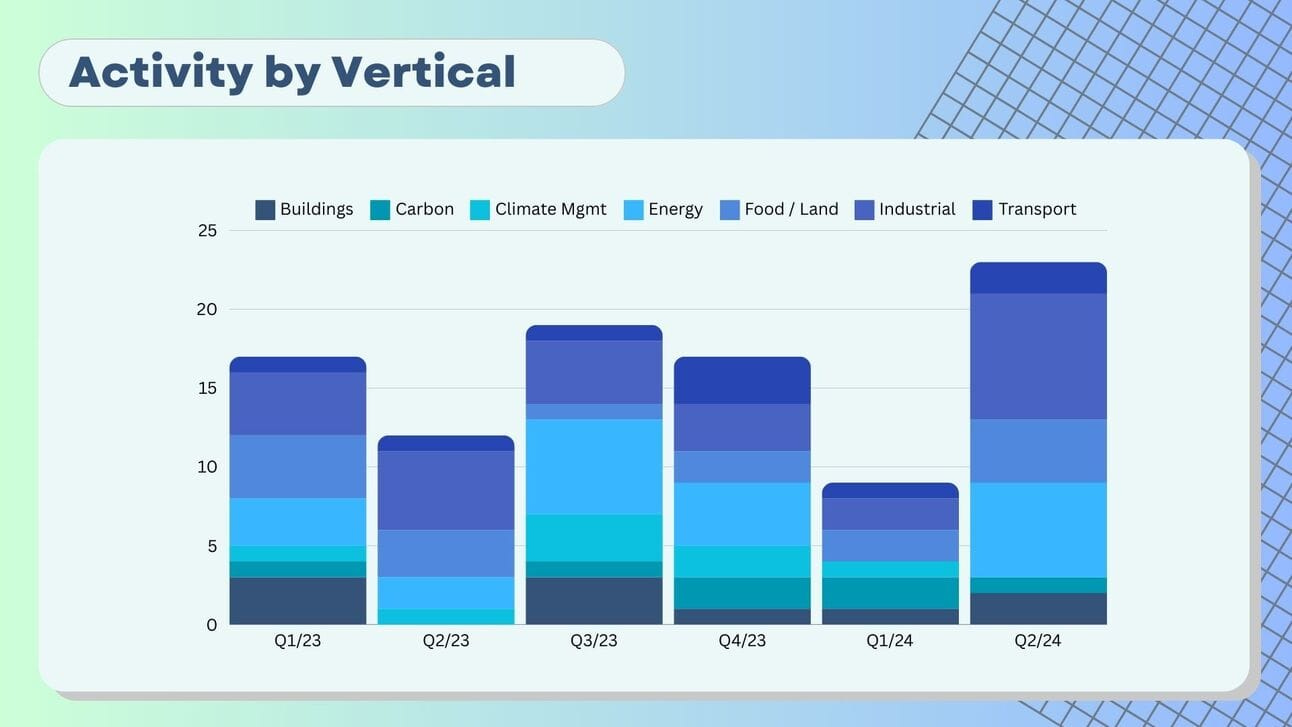

Q1 was a ghost town - but Q2 was the most active quarter since 2022

Energy, Industrial and Food & Land Use were the most active verticals.

You can check out our recap for 2023 here.

📝 A quick note about the data before we dive in: It’s a small dataset which means totals and averages can be easily skewed by one or two data points. Take it all with a big ol’ spoon of salt. If you’re curious about the methodology, I have some notes at the end.

I hope this data sparks some conversations and sheds light on some overlooked opportunities for climate action. Let’s get into it!

New here? Sign up for our weekly newsletter to get the latest news, milestones and trends in Canadian climate tech 🇨🇦

The 50,000 ft view

In the first half of the year, climate tech companies raised almost $650 million across 32 deals. That’s a 38% increase in total dollars raised compared to the same period last year.

Notable rounds include FLO’s $136 million Series E, ClearSky Global’s $228M raise, and Series B raises from SWTCH, Parity, Poseidon Ocean Systems and others.

The uptick in Canada contrasts with what’s happening globally, where climate tech investments went the opposite direction, dropping 20% YoY and 26% from Q1 to Q2.

Quarterly trend

Breaking down the Canadian data into quarters, we can see that Q1 was a ghost town. We tracked just nine rounds and a total of $61 million raised.

For context, the next lowest quarter since the beginning of 2022 was Q2 of last year, with $163 million.

Q2 was a very different story. It was the most active quarter in Canadian climate tech since the beginning of 2022 and was also the best Q2 in terms of total capital raised.

One quarter doesn’t make a trend, but it’s a positive signal. Betakit reported that Canadian tech investors generally think the market has hit the bottom and now expect a slow, bumpy recovery - could this be the start?

Deal size declines

One of the main trends so far this year is a shift to smaller raises when we look beyond some of the large outlier rounds. The average round was just over $20 million, up from $16.7 million, but the median raise fell to $6 million from just over $10 million.

A few large raises brought the average up, but most of the rounds we saw so far this year tended to be 40-50% smaller.

What’s getting backed?

Industrial, Energy and Food & Land Use continue to be some of the most active verticals.

A particularly strong sub-sector was Alternative Proteins which saw several raises including Maia Farms’ pre-seed and seed rounds from Opalia and Save Da Sea.

Open Space

Just as interesting as what sectors are getting funded are the areas being overlooked. Two themes stood out to me:

First, we’ve seen consistently less activity in Carbon and Climate Management. There have been a few raises this year, including, TerraFixing (carbon removal), Marine Labs (climate management), Carbonova and Cnergreen (both carbon utilization). But these continue to be underinvested in, particularly given the strong case for a Canadian carbon removal ecosystem.

There’s also a huge gap in funding beyond decarbonization. Over the last two years, 71% of funding went to decarbonization, 13% to monitoring and 14% removal. Regeneration and adaptation are basically rounding errors. An emphasis on decarbonization makes sense given the challenge in front of us. But there’s work to be done in other areas too, particularly in the adaptation space as extreme weather brings the impacts of a changing climate home.

Funding sources

Canadians are investing in Canada. The majority of investors that participated in deals were Canadian - about 66% - and Canadian funds led or co-led half of all rounds.

A small number of government-backed funds are doing a lot of heavy lifting. BDC Capital, Export Development Canada (EDC) and Investissement Quebec were the only funds to participate in more than two deals, joining 6, 5 and 4 respectively.

I tracked just two Canadian climate funds that raised new capital - Idealist raised $50M from the Canada Growth Fund, and ArcTern Ventures closed their $450M Fund III. This year is currently on pace to see the fewest total dollars allocated to Canadian VC funds in a decade according to RBCx.

It’s also worth calling out the funding gap left by SDTC’s pause. In 2023, we tracked more than $85 million from the agency. This year? $0.

Do you have a different take on what’s happening in climate? Interested in contributing to our dataset? Give me a shout at hello@climatetechcanada.ca.

Thanks,

Justin

Appendix

Funding Data: This report focuses on venture funding. PE, corporate strategic investments, project funding etc are excluded. The data is based on public fundraising announcements and deals are cross-referenced with other sources like Pitchbook.

The dataset is small, so including / excluding a single data point can skew the totals and averages. I’ve called this out where possible, but take trends with a grain of salt.

You may also see some numbers change from previous reports where I used a more generous interpretation of climate tech.

Definitions: Companies are considered climate tech when they’re developing technology that intentionally and significantly reduces emissions or monitors and quantifies climate impact. It can also include technology with an explicit focus on enabling mitigation technologies or adaptation to climate change. I borrow from CTVC’s definitions.

Several readers have offered their input on defining climate tech - if you have thoughts on this, I would love to hear from you!