CTC #56 - Canada Growth fund debuts with Eavor investment

Plus - Funding for sustainable proptech, all the climate events you need to know about this month, and the feds pull back on carbon pricing.

Hey there,

Welcome to another issue of Climate Tech Canada! We’ve got a lot to cover today after taking last week off.

For readers in Ottawa, myself and a few climate folks are hosting a climate tech social on November 16th at Beyond the Pale. I hope you can make it out if you’re in the area!

This week in climate tech:

Canada Growth Fund debuts with $80M investment in Eavor

Liberals flinch on carbon pricing

A look ahead at November climate tech events

Eavor closes $182M Series B with Canada Growth Fund debut

Calgary-based geothermal startup Eavor closed $182M in Series B funding after landing an initial $80M from Austrian oil and gas company OMV and existing investors earlier this year.

Eavor is developing a closed-loop geothermal solution to provide clean, baseload and dispatchable power. Their solution acts like a giant underground radiator, circulating a proprietary working fluid through a closed system. The fluid harvests the ambient heat from deep in the earth to be used for heating or electricity generation.

The Eavor-Loop is different from traditional geothermal in that it’s a closed loop vs fluid from a reservoir and can be deployed in a wider range of locations rather than relying on specific geologic conditions.

How Eavor got here:

2019 - graduated from CDL Rockies and landed $8.7M from Emissions Reduction Alberta, Alberta Innovates and SDTC to develop a demonstration plant

Ended 2019 with a $15M Series A from Singapore’s Vickers Venture Partners

2020 - announced two commercial projects in Germany and the Yukon

2021 - raised another $50M from energy industry investors like bp Ventures, Chevron Ventures, Temasek and BDC, followed by $4.3M from SDTC

2022 - kicked off another demonstration project which led to a $10M follow-on investment from bp Ventures

And now a $182M Series B with investors like OMV, Microsoft’s Climate Innovation Fund, and the Canada Growth Fund

This latest round introduces a new ecosystem player - the Canada Growth Fund. The fund was created in the 2022 federal budget with $15 billion and a mandate to de-risk climate tech investments for the private sector and help companies scale up. Eavor’s round is the perfect example of this - proven technology that’s ready to go and needs solid capital to reach scale.

The Canada Growth Fund is getting ready to get going with roughly 60 investments in the pipeline according to a recent interview with the fund’s CEO, spanning major industrial decarbonization projects, direct investments in climate startups, and eventually, supply chains for critical industries. The fund plans to deploy the full $15 billion in the next five years.

While it’s early days, the CGF could be an important addition to the ecosystem as the journey from startup to scale-up remains one of the biggest hurdles for Canadian climate ventures.

💰 Funding

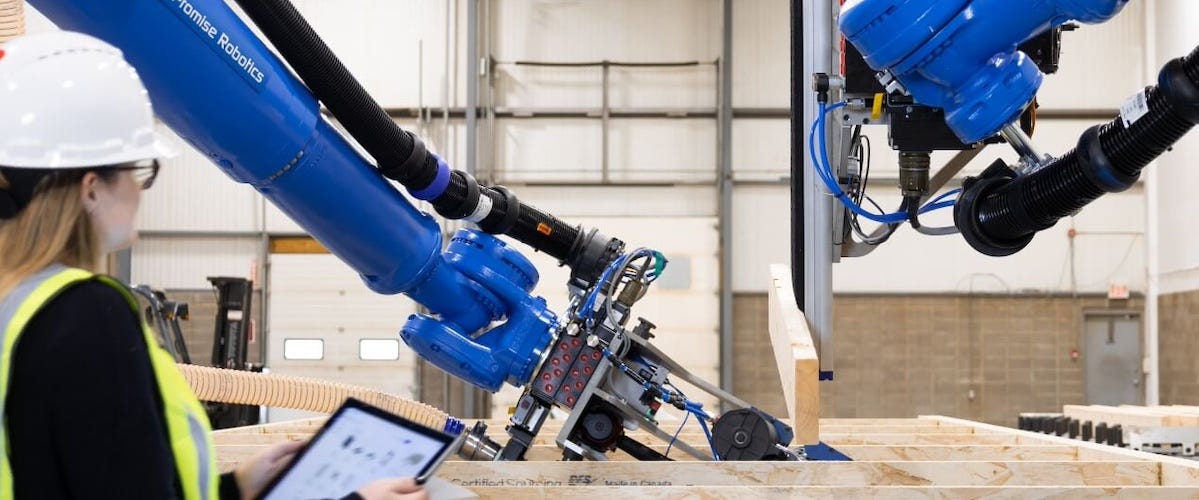

🤖 Promise Robotics (Toronto, ON) secured $20.8M in Series A funding for its robotic construction platform. Promise’s platform helps homebuilders automate construction to reduce costs, speed up project delivery and cut emissions. The company estimates 560 MT of emissions per 1 million new homes.

🌋 Eavor (Calgary, AB) closed $182M in Series B funding led by Austrian oil & gas company OMV and with participation from the Canada Growth Fund for its geothermal energy solution. Eavor has developed advanced geothermal technology using a closed loop system to capture energy from the earth. Eavor previously raised $80M in an initial close.

🚢 Glas Ocean Electric (Halifax, NS) raised $2M in seed funding from NY-based Ocean Zero for its electric hybrid drive systems for boats. The system integrates with existing diesel engines to reduce emissions and improve efficiency. Glas Ocean is working with national defence innovation programs in the U.S. and Canada.

⚛️ ARC Clean Technology (Saint John, NB) received $7M from the federal government’s Electricity Predevelopment Program to support the deployment of ARC’s small modular reactors at the Point Lepreau Nuclear Generating Station.

💨 The B.C. Centre for Innovation and Clean Energy announced $2.82M in non-dilutive funding to three Vancouver-based climate tech startups developing measurement, monitoring, and verification (MMV) solutions for carbon reduction.

Arca will develop MMV technology for carbon mineralization in alkaline waste

Metaspectral is developing a method to assess the carbon sequestration capacity of land using hyperspectral imagery

Miraterra is creating fast and affordable ways to test and measure the permanence of carbon sequestered in soil

🏍️ Damon Motors (Vancouver, BC) will go public on the Nasdaq through a reverse merger with California’s Inpixon, a real-time location systems developer. Damon Motors develops smart, high-performance electric motorcycles and will form a new entity with Inpixon’s UK-based data analytics and visualization business

🏅 Milestones & growth

Ecobee founder Stuart Lombard is retiring after leading the company to acquisition in 2021 and helping users save more than 28 terrawatts of energy.

Canada’s RainStick Shower and Li-Metal’s molten salt bath to produce lithium were both named to Time’s Best Inventions of 2023

Dalhousie University’s ideaBUILD and Invest NS’ Accelerate both accepted five climate startups into their latest cohorts, with solutions across ag-tech, energy, consumer goods and more.

🗞️ This week in climate

🌡️ A slippery carbon pricing slope: The feds introduced a three-year carbon pricing exemption for home heating oil and higher rebates for people living in rural areas. They’re also improving incentives for heat pump adoption including a $250 upfront payment and higher maximums for grants. Home heating oil is mostly used in Atlantic provinces, which just entered the federal carbon pricing framework in July. It looks like a pretty blatant attempt to win votes as the Liberals have been struggling in polls in Atlantic Canada.

It’s a significant risk for carbon pricing more generally. It’s the first time the feds have backed down on carbon pricing since it was introduced and has not only opened the door for everyone to start asking for exemptions, but implicitly confirmed that carbon pricing is “too costly”.

📊 EDC: Canada could fall behind on climate tech R&D: A new report from Export Development Canada laid out a range of challenges for Canada’s climate tech sector despite a 4x increase in investment since 2018:

Not enough private R&D spending (outpaced by OECD countries by >2x)

Difficulty converting startups to scale-ups

A lack of local investors (and reliance on government funding)

And pressure from other markets (e.g. IRA, REPowerEU)

The findings aren’t necessarily new, but reinforce sentiments shared by VCs, founders and other players in the ecosystem for a while.

🔋 Li-Cycle pauses “pivotal” battery recycling facility: Kingston, ON’s Li-Cycle paused work on a new battery recycling plant in Rochester, NY due to escalating construction costs despite a $375M US loan from the US Department of Energy earlier this year. Li-Cycle is one of many clean energy developers facing similar issues, with other projects running into financial roadblocks from high interest rates.

Li-Cycle has taken an ambitious approach, growing quickly to capture the nascent battery-recycling market and went public via SPAC in 2021 to raise more than $600M US. Their Rochester plant was going to be a critical “hub” plant that processed materials from their smaller spoke plants already in operation.

In other news

Canada will invest more than $1B over 15 years in satellite technology to improve the earth observation data it uses to track environmental crises

The feds launched the $1.5B Critical Minerals Infrastructure Fund to invest in mines, clean energy and transportation infrastructure needed to develop critical minerals projects

Some Canadian companies will need to meet new climate disclosure regs in Europe. The disclosure goes beyond climate-related risks and includes direct environmental impacts

Japan may cover up to half of project costs for Japanese companies to develop low-carbon fuel projects in Canada

Toronto will require all taxi and ride-share vehicles to be zero-emissions by Jan 1st, 2031 and introduced a $10M grant program to support the transition

Montreal will ban gas hookups for new buildings under three floors starting in October 2024, with the ban extending to larger buildings in 2025

Autoworker strikes could be coming to an end as Unifor and UAW reach deals with Ford, Stellantis and GM. It’s been six weeks of strikes as unions and automakers hashed out how workers would be impacted by the transition to EVs

Automakers like Tesla, GM and Volkswagen are dialling back their EV ambitions as they expect demand to slow due to high interest rates on car payments

Meanwhile, B.C. proposed legislation to hit 100% zero-emission vehicles sales by 2023, five years faster than its initial goal.

Alberta may reduce liabilities for oil and gas companies on old well sites, making it easier for operators to sell old wells.

Concordia University launched its “Volt-age” research program focused on electrification, smart buildings and net-zero communities

📣 What’s going on

📅 We've got you covered with all the essential Canadian climate tech events going on in November. Hosting an event that isn’t on the list? Hit reply to let me know.

Carbon Removal Canada Launch: Featuring speakers from across Canada’s carbon removal ecosystem, this event introduces Canada’s newest carbon removal advocate. Nov 8th, Ottawa.

Foresight 50 Showcase: Announcing Foresight’s 2023 “most investible” climate tech ventures followed by an all-day investor forum. Nov 8-9th, Calgary.

NZAB - Building Momentum Toward Net Zero: Hosted by the Canadian Climate Institute and the Net-Zero Advisory Body, this event features discussions with climate policy experts on Canada’s path to net-zero. Nov 9th, online.

Smart Growth Symposium: UofT’s Climate Positive Energy initiative hosts this half-day event exploring smart and clean technology solutions. Nov 21st, Toronto.

R3 Capturing Climate Opportunity: Hosted by the New Brunswick Innovation Foundation, this event will connect the region’s climate innovators and investors. Nov 23rd, Saint John.

MaRS Climate Impact: Bringing together the world’s foremost tech and finance leaders to speed up the adoption of climate solutions. Nov 29-30th, Toronto and online.

💡 New accelerators & programs:

Ocean Climate Solutions Program: Canada’s Ocean Supercluster is accepting applications for projects across ocean-based carbon capture, ocean observation, bioresource development and more. Applications close Dec 6th.

Energy Innovation Program – Smart Grids: This NRC program is seeking applications for grid modernization, energy affordability, and emissions reductions. Applications close Jan 2024.

Net Zero Emerging Concepts and Technologies: The program focuses on taking emerging made-in-New Brunswick innovations that reduce emissions from lab to market. Applications close Nov 22nd.

Women4Climate Toronto: The mentorship program empowers and supports female climate leaders who are working on innovative climate solutions in Toronto. Applications close Nov 20th.

☕️ Here & there

A few of my favourite long-reads to help you sound smart this week

6 startups taking the CO2 out of concrete

Will this be the year of micro-M&A in climate?

De-bunking 21 myths about electric vehicles

Banks are making more from climate financing than from fossil fuels - again

The best-selling EV in Japan is an $18,000 kei car

📌 Jobs

Featured postings from Canadian companies building climate solutions

➡️ Hiring? List your posting here.

That’s all for this week - thanks for reading!

Justin