How Canada's battery innovators are outpacing China

Exploring the driving forces behind battery supply chains and the startups putting Canada on the map.

Welcome to a weekend edition of Climate Tech Canada! Canada recently topped BloombergNEF's global battery supply chain report, beating out China for the first time. Today, we’re going behind the headline to understand what's driving the global battery market and how Canadian ingenuity is taking on the biggest bottlenecks. Let’s go!

⚡️ Charging up the rankings

What happened: Canada recently topped BloombergNEF's global battery supply chain report, beating out China for the first time. The report ranks countries on their potential to build out reliable and sustainable lithium-ion battery supply chains.

The key drivers according to Bloomberg: consistent advances in manufacturing and production, strong ESG credentials, integration with the US auto sector, and government policy commitments.

Why it matters: The supply of battery materials is one of the hottest topics in climate and is shaping foreign policy and development around the globe. Global demand for materials is expected to grow between 2x and 3.5x by 2030.

Some specific minerals - like copper and nickel - are at risk of tapping out known reserves. Solutions like EVs and wind turbines use many times more critical minerals than their fossil fuel alternatives.

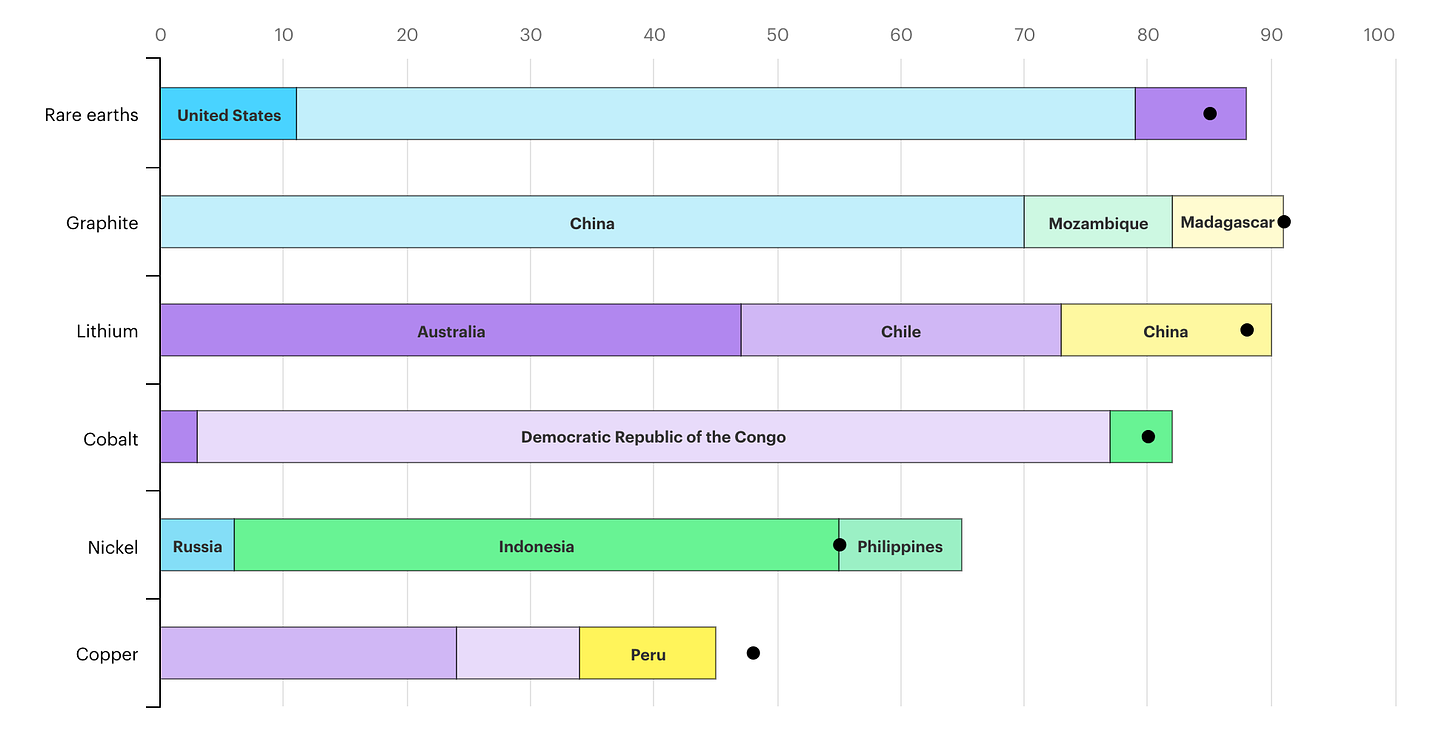

Bus factor: Increasing supply isn’t enough on it’s own - supply chains also need to be diverse, avoiding dependencies on individual countries or suppliers to mitigate price shocks or access issues. For example, late last year Manufacturers had to scramble to find new sources of graphite when China, which produces 65% of the world’s graphite, decided to restrict exports.

Today, top producers like China, the Democratic Republic of the Congo, and Indonesia still dominate mining for critical minerals. China produces >60% of rare earths, and the DRC 74% of cobalt.

Refining is even more skewed, with the overwhelming majority of refining concentrated in China. The result: raw materials like lithium are often shipped overseas to be refined, increasing costs, carbon emissions and supply risks.

With EVs and clean energy poised to be major drivers of economic opportunity in the coming decades, diversifying supply chains is a huge focus for Canada and its allies in the U.S. and EU.

🚀 Where Canada’s playing

Canadian startups are developing solutions across the battery materials supply chain, tapping into a wealth of resources, industry knowledge, government support and partnerships with mining companies.

📡 Exploration

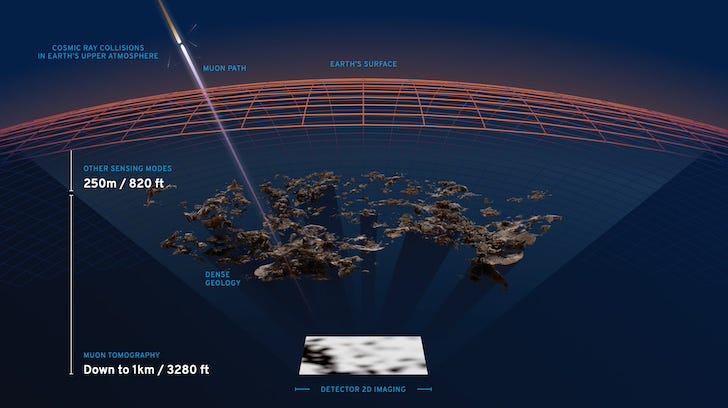

To tackle this problem, companies like GeologicAI are using artificial intelligence to process core samples and identify the quality and value of ores faster. Ideon harnesses cosmic radiation to build X-ray-like maps of mineral deposits up to a kilometre below the Earth’s surface.

Imagine you’re paying $10M to explore for minerals and see if a deposit is viable. If you can increase the success rate from 90% to 99%, that’s a dramatically higher return when you’re talking about multi-billion dollar finds. Less intrusive exploration methods also mean more shots on goal without disrupting the local environment.

Better exploration has the potential for huge returns, and companies like U.S.-based KoBold Metals have raised hundreds of millions from firms like Breakthrough Ventures to tap into this market.

⚒️ Extraction

Another way we can increase the abundance of materials is by improving how we extract materials. ph7 Technologies is recovering copper from low-grade ores and recycled materials by running a solvent over the material in a closed-loop system. The approach can help make low-grade sources economically viable while reducing the pollution, water and energy use from traditional methods.

With these ESG concerns in mind, Summit Nanotech is developing a new way to extract lithium from saltwater brines. Summit not only avoids the disruption from hard-rock mining, but also uses dramatically less land than traditional evaporation methods and can return the brine to the aquifer to preserve its integrity and mitigate environmental impacts.

🏭 Refining & Production

Domestic extraction only goes so far if you’re shipping the materials around the world to be refined. To build up local refining capacity, Mangrove Lithium developing a modular, cost-effective refining process that converts lithium directly into battery-grade lithium hydroxide.

Others are working on producing high-performance materials with better energy density and longer lifespans. Nano One Materials is developing high-performance cathode materials from nano-sized crystals covered with protective coatings that improve durability for fast-charging. Li-Metal and Nanode Battery Technologies are tackling high-performance anodes for lithium and sodium batteries.

Another opportunity is vertical integration for mining companies. Canada Nickel announced they will build a $1B nickel processing facility in Ontario, North America’s largest. Others like Avalon Advanced Materials and Electra Battery Materials are building out capacity for lithium hydroxide and cobalt.

🔋 Better Batteries

An alternative route to resilient supply chains is diversifying battery chemistries. Some companies are sidestepping the most in-demand or expensive materials in favour of alternatives like sodium and zinc, which are far more abundant and easier to access.

Companies like eZinc and Salient Energy are developing zinc-metal and zinc-ion battery technologies for long-duration energy storage. Zinc batteries typically have high energy density, are more stable due to their water-based design, and less prone to thermal runaway.

♻️ End-of-life

Finally, there's a huge amount of battery materials out there already. Companies like Li-Cycle are starting to tap into this with new recycling tech. Li-Cycle uses a hub-and-spoke model to shred and process materials close to their source, and then ships them to a central hub for refining into battery-grade materials.

Lithion Technologies is repurposing existing industrial processes in new ways to recycle battery materials, while Cyclic Materials and Geomega Resources are targeting rare earth magnets. RecycliCo adds a diversification angle to the recycling problem with its modular recycling systems. This enables on-site recycling, either close to the point of collection or near battery manufacturers.

The battery recycling market is expected to double by 2030 as EV batteries reach the end of their life. Recycling also reduces the pressure on primary supply by 10% and delivers a better ESG profile by mitigating new mining and replacing traditional smelters that consume a lot of energy and produce pollution.

🔋 Putting it all together

There’s a reason that Canada is top of the ranks for supply chain potential:

We have the know-how. Canada is the 7th largest auto exporter and produces 1.4 million vehicles a year. There are more than 125,000 workers in the sector, and we’re tightly integrated with the U.S. auto sector. Umicore, Volkswagen, Ford, Northvolt, Stellantis and LG Energy are all picking up on the potential.

We're a mining superpower. 3/4 of the world's mining companies call Canada home and we have an abundance of resources. Mineral exports in 2021 were $126B or 22% of total exports.

We’re creating demand. The Electric Vehicle Availability Standard will turn all new vehicles sales into zero-emissions vehicles by 2035 and a growing number of cities and commercial fleets are electrifying their vehicles.

The future of batteries is anything but guaranteed, but Canada is well positioned to capture the moment and build a long-term advantage.

Justin

These are such helpful updates! Thank you